28 OCT 2025

Innovate to thrive

Tissue can expect solid growth but must innovate to thrive. This was one of the key takeaways from the presentation to Södra customers in Barcelona by Natalia Bezrebra, a Senior Analyst at Euromonitor International. We asked Natalia to drill down into the detail.

In which tissue distribution channel is growth the strongest at the moment?

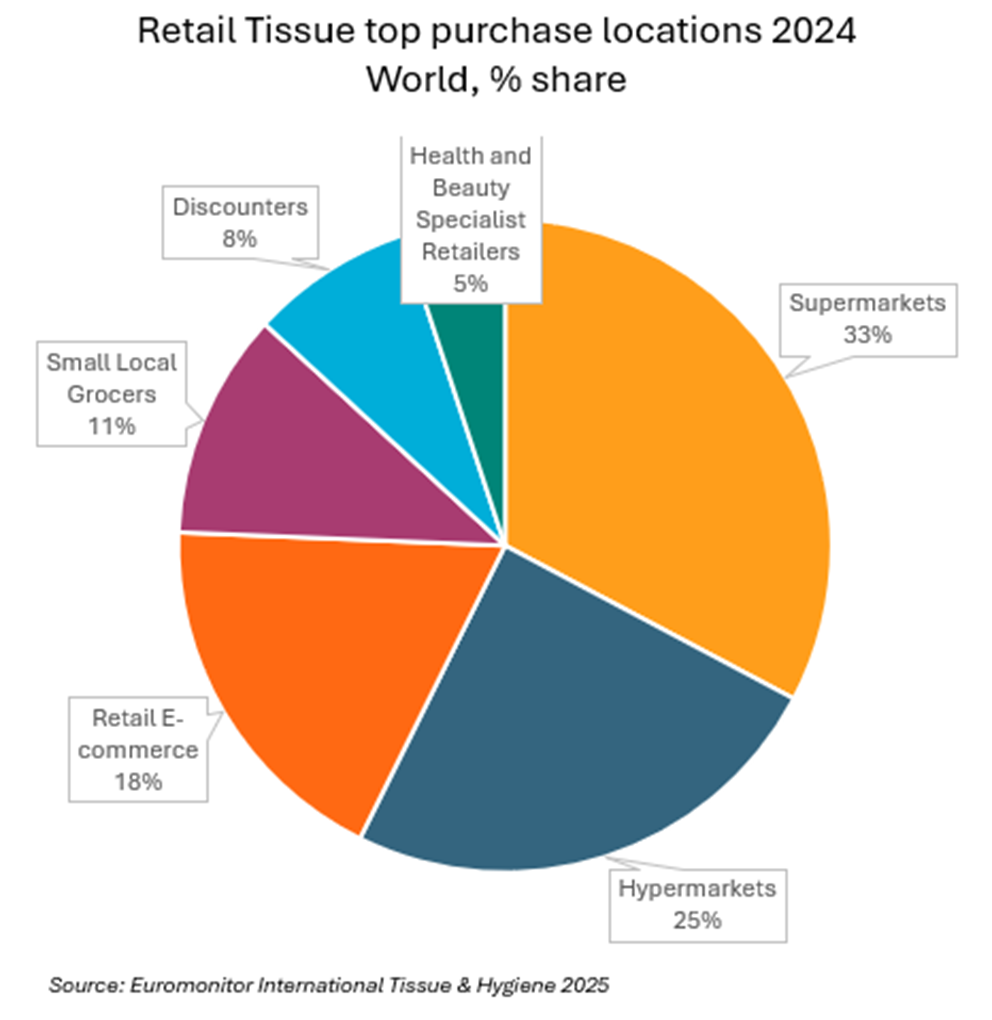

In percentage terms it’s retail E-commerce, which saw growth of 163 percent between 2019 and 2024. It’s now close to 20 percent of all retail sales worldwide, which puts it ahead of local stores and just under a third the level of sales at supermarkets/hypermarkets.

How about the market overall? Are tissue sales still in positive territory?

Yes - it’s not spectacular but solid. In 2024 global retail tissue grew around 1 percent in constant terms, that is excluding inflation to US$ 105 billion (in current value terms, including inflation, growth was 5 percent over 2024). Away-from-home (AFH) grew by a healthy 2 percent in constant terms (+5% in current terms) to US$ 30 billion. Asia Pacific is comfortably the biggest market overall, although North America leads in AFH.

Looking at our “local” market of Europe, how are the different tissue categories evolving?

The categories remain fairly fixed in relative terms, with toilet tissue way out in the lead followed by paper towels, and then pocket handkerchiefs, tableware (including napkins and tablecloths) and boxed facial tissues evolving from a much lower base. We see the prospect for further growth until the end of the decade to be healthy in Western and Eastern Europe. Take retail tissue in Eastern Europe as an example, where we see sales rising from US$5.6 billion in 2024 to US$6.6 billion by 2029 at today’s prices. Sales were US$4.8 billion in 2019 so that’s growth of more than 37 percent in a decade. In the equivalent period in Western Europe we see retail tissue sales rising from US$17.5 billion to US$23 billion – a more modest increase proportionately, but still substantial.

What is driving demand?

According to our Consumer Lifestyles Survey*, consumers appear to prioritise hygiene but combined with convenience.

Meanwhile urbanisation is driving demand for better lifestyles. While consumers actively seek out features such as softness, strength and premium design, they demand value for money choices. One approach manufacturers are taking is to offer multi-functionality to deliver practicality and savings. More than 70 percent of respondents are concerned about the rising cost of everyday items but nearly the same number are looking for ways to simplify their lives and are perhaps prepared to pay for this.

How about sustainability – how high up is that on the list of priorities?

According to our survey, 27 percent of consumers buy sustainably produced items specifically to have a positive impact on the environment. While that is less than a third, it is still a large number of consumers who prioritise the environment in their purchasing decisions.

So what can manufacturers do to stand out?

From a sustainability point of view, the use of recycled materials for the product and packaging, compostability of kitchen towels and use of alternative materials are all options which chime with the consumer. From a broader consumer-centred, value-creating perspective, initiatives include: technology such as tube-free rolls; improved quality – three-ply for example; reusability – some kitchen towels are wringable and reusable; premiumisation such as extra softness. Multi-functional products also have an appeal, including those with lotions added which therefore care as well as clean, or scented products which provide fragrance in addition to function.

And how are manufacturers responding?

55 percent of industry respondents to our Innovation Industry Survey** have launched new products in response to changing consumer trends. And 49 percent report that their company is implementing a sustainability strategy. So there is lots of activity, but also plenty of scope to go further.

The following surveys were referenced in Natalia Bezrebra’s presentation:

Euromonitor International Tissue & Hygiene 2025 edition

Euromonitor International Packaging 2025 edition

Euromonitor International Economies and Consumers Annual Data

*Euromonitor International Voice of the Consumer: Lifestyles Survey, fielded January-February 2025

Euromonitor International Voice of the Consumer: Sustainability Survey, fielded January-February 2025

Euromonitor International Voice of the Industry: Sustainability Survey, fielded March-April 2025

**Euromonitor International Voice of the Industry: Innovation Survey 2024